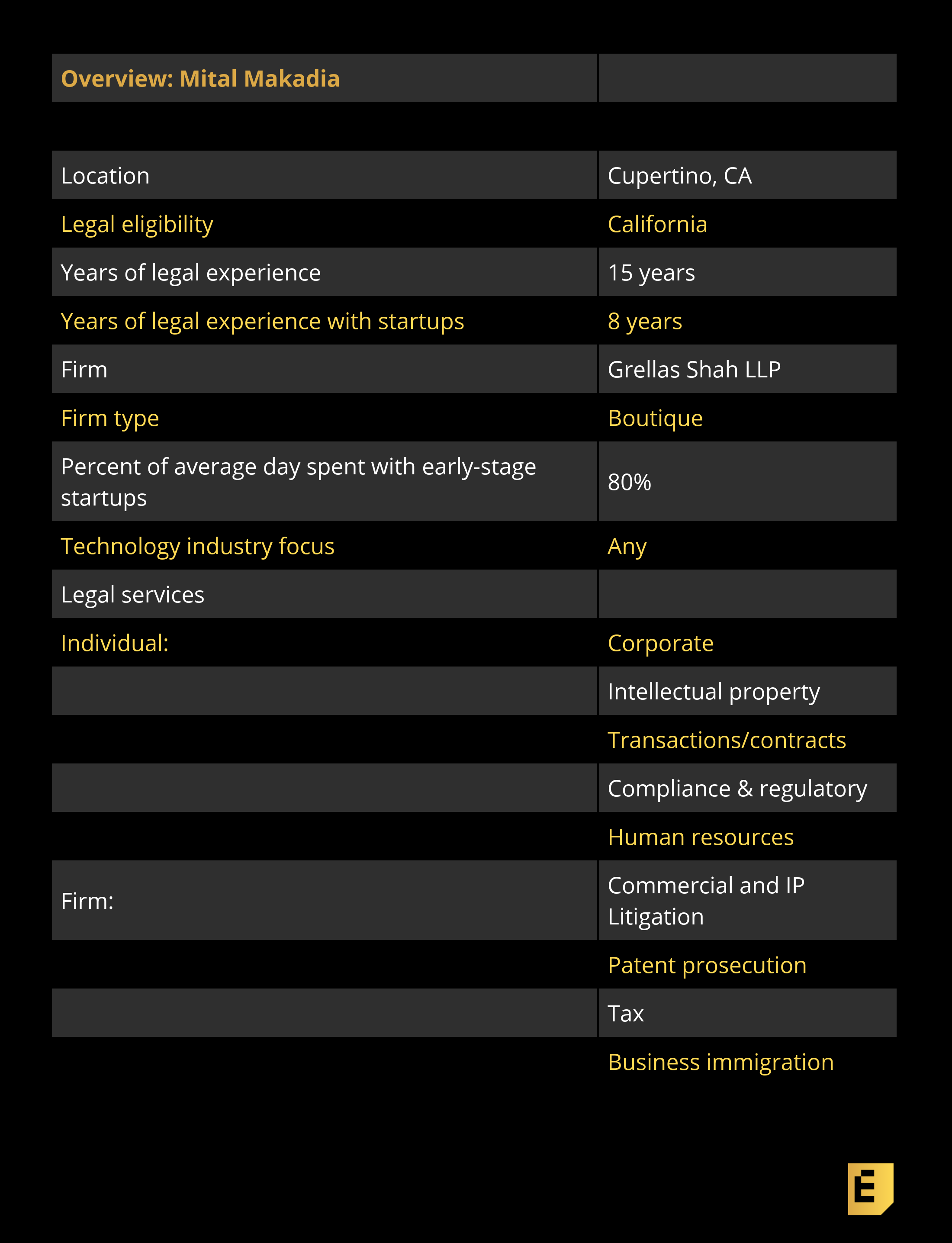

Mital Makadia’s legal career began on the East Coast, with Big Law firms, but she moved into early-stage startup work with long-time Silicon Valley boutique Grellas Shah nearly a decade ago. She’ll work with companies on a range of usual startup issues, but she and the firm also focus on individual founder representation (when it comes to that).

As part of the interview below, we got into a conversation about contentious terms in term sheets — and she ended up writing a guest post for us about the biggest gotchas that she sees in Series A docs. Read up on her here, then go check out What To Watch For In A VC Term Sheet.

On the founder focus:

“We approach the practice with a view to protecting the founders. So we’re not looking to please the VCs. And if that means reviewing the transaction a little bit differently then what the investors are used to, that’s fine by us. That’s pretty much our philosophy.”

“Mital has an amazing ability to analyze complex issues and, not only explain them clearly, but also give us spot-on recommendations on what to do next to keep the company moving.” Bryant Lee, San Francisco, cofounder and CEO, Cognition IP

On the different perspective:

“For me, I have been through enough financing rounds to know what VCs tend to push for and what’s ‘market’ at a given point in time. But just because a provision might be one my client will likely have to give on, depending on negotiating leverage, I make sure my client understands how it impacts the company and its founders. I don’t simply gloss it over as “market.” And sometimes in those conversations, I suss out legitimate concerns from clients that we can creatively address. But that requires you to have a founder hat — not a VC hat – on when you are reviewing a term sheet.”

On second looks:

“Now, we have a lot of clients who come to us, whether they’re going through an M&A or whether they’re incorporating or whether they are going through a financing round term sheet who may have a lawyer representing the company, but who wants our advice in protecting the founders.”

Below, you’ll find founder recommendations, the full interview, and more details like their pricing and fee structures.

This article is part of our ongoing series covering the early-stage startup lawyers who founders love to work with, based on this survey and our own research. The survey is open indefinitely so please fill it out if you haven’t already. If you’re trying to navigate the early-stage legal landmines, be sure to check out our growing set of in-depth articles, like this checklist of what you need to get done on the corporate side in your first years as a company.

Full Interview:

Eric Eldon: I would love to hear about how you got into working with startups, given your very different focus earlier in your career.

Mital Makadia: Actually, I didn’t start my legal career working with startups. After law school, I did general corporate work at large firms in New York and DC. That feels like a lifetime ago.

Mital Makadia: Actually, I didn’t start my legal career working with startups. After law school, I did general corporate work at large firms in New York and DC. That feels like a lifetime ago.

I eventually moved out to the West Coast when I got married and came across Grellas Shah when I started looking for a job here. I can’t say my goal was necessarily to work with startups at that point. But I loved this practice from day one.

Of course, I immediately loved working with entrepreneurs. The brilliant new ideas, enthusiasm, optimism, work ethic, and ambition is infectious.

But a huge part of what I have loved about this practice is working with and learning from our firm’s founder, George Grellas. George has been working in Silicon Valley since 1983 and has really seen the ups and downs in the tech industry. Largely due to his reputation as a sharp yet practical startup attorney, our firm has built an enviable client base, which has been an ideal platform for me to launch my own career in the startup world.

from TechCrunch https://ift.tt/2W474Nk

//

0 comments:

Post a Comment